Knowing the tax changes that apply for the 2023 tax year will give you a step up in planning and can impact your bottom line.

Proper tax planning requires an awareness of what’s new and changed from last year — and there are lots of tax law changes and updates for 2023 that you need to know.

- The government’s massive year-end funding legislation, the SECURE 2.0 Act contains a slew of retirement provisions, with some important ones taking effect for 2023.

- Green-energy tax breaks for buying electric vehicles and making home improvements were included in last year’s Inflation Reduction Act.

- And last year’s high inflation numbers made the income tax brackets and other inflation-adjusted figures soar.

This blog series will recap the most important tax law changes and adjustments for 2023, with some related items grouped together.

The 1st series in our blog post will cover income tax brackets, long-term capital gains tax rates, standard deduction and 1099-K forms.

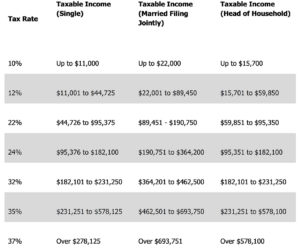

Income tax brackets: Tax rates didn’t change but the income tax brackets for 2023 are much wider than for the previous tax year due to rising inflation during the year.

2023 Tax Brackets for Single/Married Filing Jointly/Head of Household

Long-term capital gains tax rates: Tax rates on long-term capital gains (i.e., gains from the sale of capital assets held for more than one year) and qualified dividends did not change for 2023. The income thresholds to qualify for the various rates were adjusted for inflation.

- 0% rate applies for 2023 individual taxpayers with taxable income up to $44,625 on single returns, $59,750 for head-of-household filers and $89,260 for joint returns.

- 20% rate for 2023 starts at $492,301 for singles, $523,051 for heads of household filers and $553,851 for couples filing jointly.

- 15% rate is for filers with taxable incomes between 0% and 20% breakpoints.

The 3.8% surtax on net investment income stays the same for 2023. It kicks in for single people with modified adjusted gross income over $200,000 and for joint filers with modified AGI over $250,000.

Standard Deduction: There is an increase for the 2023 stand deduction to account for inflation.

- Married couples filing jointly get $27,700, plus $1,550 for each spouse aged 65 or older.

- Singles can claim a $13,850 standard deduction and if 65 or older $15,700.

- Head-of-household filers get $20,800 for standard deduction, plus an additional $1.850 when they reach age 65.

1099-K forms: In 2021, Congress enacted a law requiring third-party settlement networks (e.g., PayPal, Venmo, Square StubHub) to send Forms 1099-K to payees who are paid over $600 a year for goods and services. This reporting threshold, which is much lower than in prior years, was slated to kick in for 1099-Ks for 2022. The lower reporting thresholds received lots of criticism from across the spectrum, so the IRS decided to delay them. So, as happened for the 2022 tax year, new rules that were supposed to kick in for 2023 1099-K forms sent out in 2024 won’t apply for the 2023 tax year.